Income tax calculator with overtime

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Texas. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

How To Calculate Net Pay Step By Step Example

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

. Overtime pay per year. First calculate your overtime rate. Overtime pay per period.

Monthly Overtime If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10. This calculator can determine overtime wages as well as calculate the total earnings. But calculating your weekly take-home pay.

The simplest way to work out how much. A RHPR OVTM. Then determine your gross pay for the period.

In most situations this is one-and-a-half times your hourly wage. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10. D RHPR RHWK.

If you know your tax code you can enter it or else leave it blank. This is how you work it out. Regular pay per period.

Effective tax rate 172. Using an internet overtime tax calculator can make calculating tax easy but you can also work out the number for yourself. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Overtime can be entered separately. That includes overtime bonuses commissions awards prizes and retroactive salary increases. These supplemental wages would not be subject to taxation in Texas because the state lacks.

Regular pay per year. How Your Paycheck Works. 8250 overtime wages 440 regular wages.

Register to save paychecks and manage payroll the first 3 months are free. If you do any overtime enter the number of hours you do each month and the rate you get paid. 1650 overtime rate of pay 5 overtime hours 8250 overtime wages Then add the regular and overtime wages together.

Overtime Calculator More - Free. For overtime you must enter your hourly rate then either enter the amount in the 1x 15x 2x boxes or the hours at the respective rate. E D.

C B PAPR. B A OVWK. To do this you multiply your.

If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10. Taxable income Annual gross salary - Pension Provident RAF limited to 275 of salary limited to R350k - 20 of travel allowance. If you receive BiKs like company cars enter the total.

2 Fbr New Income Tax Calculations Download Scientific Diagram

Calculate Tax Amounts

Excel Formula Help Nested If Statements For Calculating Employee Income Tax

Avanti Gross Salary Calculator

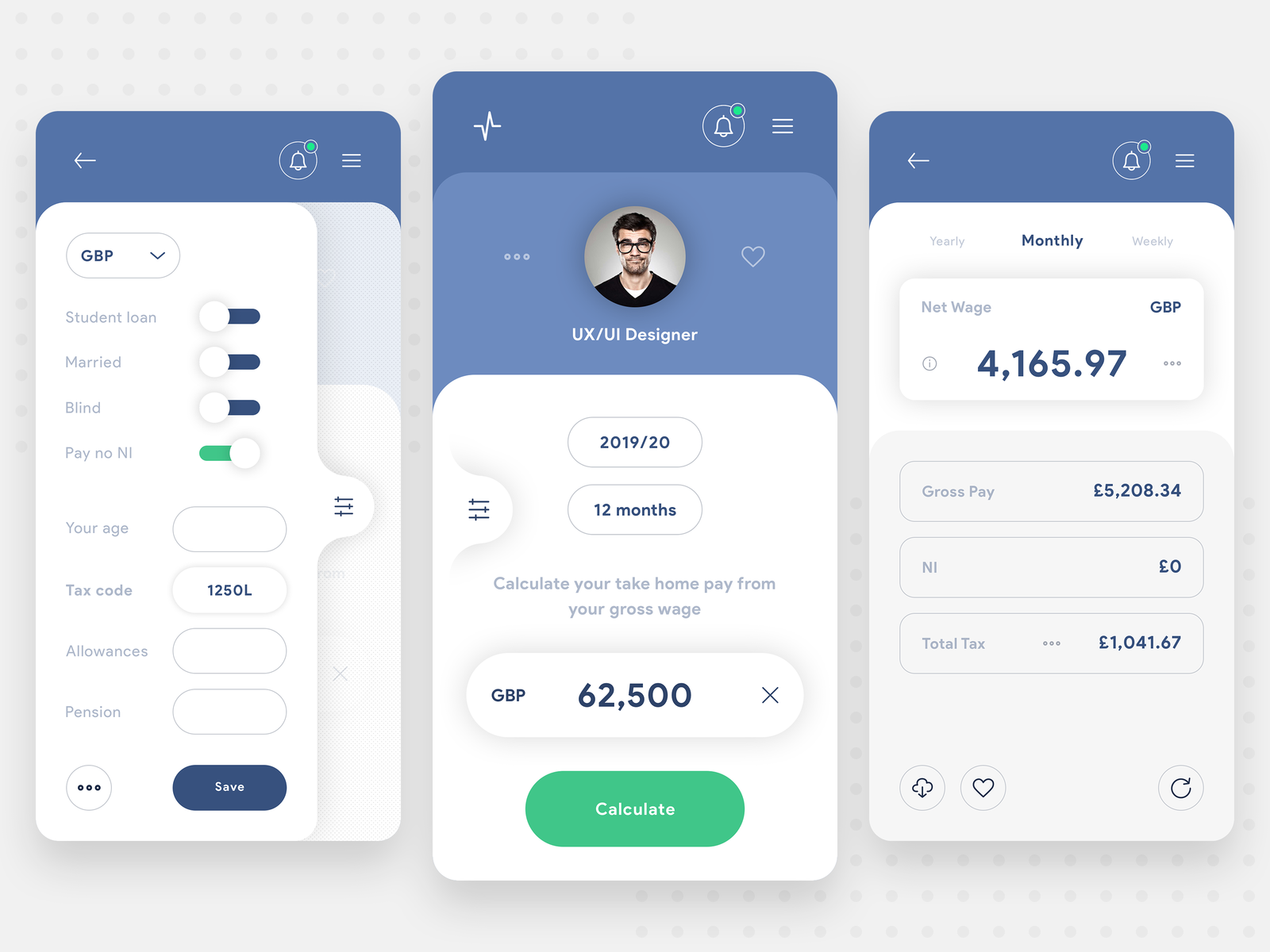

Salary Tax Overtime By Hoang Nguyen Duy

Salary Tax Overtime By Hoang Nguyen Duy

Solved W2 Box 1 Not Calculating Correctly

Salary Calculator Singapore App Development App Development Companies Mobile App Development Companies

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate Gross Income Per Month

Federal Income Tax Fit Payroll Tax Calculation Youtube

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Hourly Paycheck Calculator Step By Step With Examples

Tax Calculator For Wages Clearance 54 Off Www Prestigepaysage Com

Salary Pay Tax Calculator Suburbsfinder

How Is Taxable Income Calculated How To Calculate Tax Liability

Income Tax Calculator App Concept By Bahur78 On Dribbble